The Voice of the Exhibition Industry Market Outlook – Wave 1

It was early June 2020 when GRS Research & Strategy launched the first edition of “The Voice of the Exhibition Industry” Market Outlook. The purpose behind this initiative was to gather information about the current situation the exhibition industry was facing after 3 months of lockdown and postponement / cancellation of events, and what the expectations are for the months to come.

It is remarkable how much participation this project recorded: in just two weeks, more than 500 exhibition industry professionals from more than 50 countries took part in the research and shared their views. This allowed for an in depth analysis of the results by region (Americas, Asia & Pacific, Middle East & Africa, and Europe) as well as by seniority of respondents (34% C-Level, 23% Event Directors, 17% Marketing, 14% Sales, 11% finance / operations / other roles).

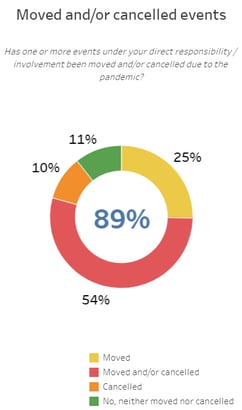

The first striking information is the percentage of respondents who have been affected by Covid-19: 89% mentioned at least one event in which they are involved was either postponed or cancelled, with no relevant differences across different regions (from 86% in Middle East & Africa and 87% in Europe, all the way up to 95% in Asia & Pacific and 98% in the Americas).

Covid-19 and the postponement / cancellation of events generated a series of problems for event organisers. Visitors not being willing or able to travel, lack of revenues that created cashflow stress, overlapping calendars with other events, and availability of venues to reschedule are currently the most critical issues.

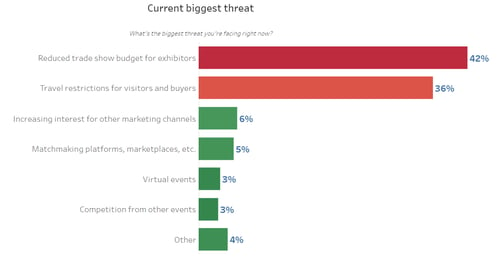

Looking ahead there are two threats that stand out: the reduced trade show budget for exhibitors (according to 42% of respondents) along with travel restrictions for visitors and buyers (36%). These are the key cause of uncertainty for the months to come, according to our panel.

But organisers are not passively waiting for the Covid-19 emergency to be over. On the contrary, 65% have arranged online activities like workshops and webinars, 45% have organized (or are currently working on) virtual events, and 44% have offered matchmaking solutions to their clients.

All these initiatives are useful in the short run, but are here to stay even after the Covid-19 emergency, particularly the matchmaking solutions (87% of those who implemented it say it will remain in the future) and online workshops and seminars (80%).

Focusing on virtual events, 72% of respondents have already reached out to technology providers to identify the best solution to host a digital/virtual/hybrid event. It is important to point out that these organisers believe these solutions will represent a valid alternative to physical events particularly when it comes to providing contents, education, and presenting innovation, and much less to generate business opportunities and new leads. Virtual events, in the end, seem to be a more valid alternative to conferences rather than to exhibitions.

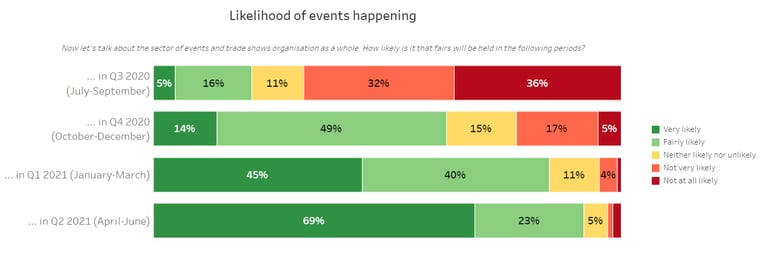

Looking at the future, the feedback collected in the first two weeks of June show some uncertainty about the likelihood that exhibitions will take place before the end of 2020. Only 21% say that exhibitions are “very or fairly likely” to take place in Q3 (values 4 and 5 on a 1-5 point scale), with 68% that (on the contrary) consider this possibility to be “not very likely” or “not at all likely” (values 1 and 2 on a 1-5 point scale). There is more confidence for Q4, when the percentage of respondents saying “very/fairly likely” grows to 63%, and the ones saying “not at all / not very likely” drops to 22%. There is definitely more confidence that events will eventually happen in 2021, with 85% of our panel who believe exhibitions will take place in Q1-2021, and 92% who expect shows to happen in Q2-2021.

Looking at the future, the feedback collected in the first two weeks of June show some uncertainty about the likelihood that exhibitions will take place before the end of 2020. Only 21% say that exhibitions are “very or fairly likely” to take place in Q3 (values 4 and 5 on a 1-5 point scale), with 68% that (on the contrary) consider this possibility to be “not very likely” or “not at all likely” (values 1 and 2 on a 1-5 point scale). There is more confidence for Q4, when the percentage of respondents saying “very/fairly likely” grows to 63%, and the ones saying “not at all / not very likely” drops to 22%. There is definitely more confidence that events will eventually happen in 2021, with 85% of our panel who believe exhibitions will take place in Q1-2021, and 92% who expect shows to happen in Q2-2021.

There are interesting differences by region, with countries that were hit first by Covid-19 that are expecting an earlier restart of exhibitions, and the ones affected later (like the Americas) who are less confident about the future.

Furthermore, our panel was asked about the expectations in terms of KPIs commonly used to measure the success of exhibitions, like the number of attendees and the revenues generated. 73% of respondents mentioned that the event(s) they are responsible for or involved in was growing before Covid-19, and only 7% were on the contrary recording a negative performance. Looking ahead, it is clear that it will take time to reach the performance recorded in the past: 60% don’t think the number of national visitors will be back to pre-Covid19 figure before the second half of 2021. Expectations are even worse when it comes to revenues and number of international attendees, with this percentage growing to 80% (and more than 40% of respondents think it will not happen before 2022 or even later).

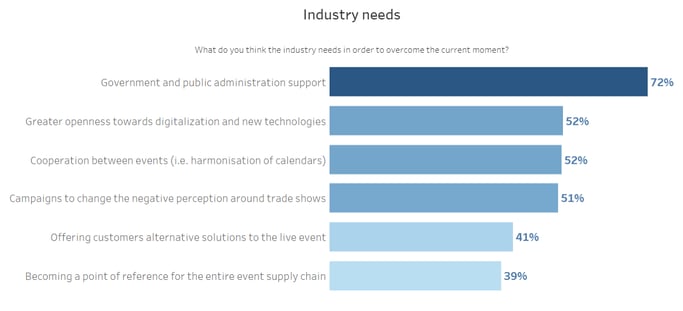

So, how do we tackle this situation? 72% of respondents agree that government will play a key role, both by creating the conditions for events to take place, as well as by providing other types of support (including financial). Important will also be a more rapid switch to digitalization and new technologies, along with a cooperation between events (i.e. harmonization of calendars). Finally, 51% of respondents also mention the importance to run campaigns to change the negative perception about trade shows.

So, how do we tackle this situation? 72% of respondents agree that government will play a key role, both by creating the conditions for events to take place, as well as by providing other types of support (including financial). Important will also be a more rapid switch to digitalization and new technologies, along with a cooperation between events (i.e. harmonization of calendars). Finally, 51% of respondents also mention the importance to run campaigns to change the negative perception about trade shows.

This is something that we at GRS Research & Strategy disagree with. The reason for this is that, across multiple studies we have conducted over the past few months, we have noticed how it’s not the exhibition itself that is perceived as “dangerous” from a health standpoint, but rather the travel part of the journey (in particular, the airplane). This leaves a lot more opportunities for local events with a limited number of international travelers. At the same time, it is worth noticing that exhibitions are the best options for those who can’t avoid travelling abroad: they allow for multiple meetings to happen in one go, with people from allover the world, thus saving time, money, and health-related risks. This is where, in our opinion, the communication of event organisers should focus on in the coming months.

To see all the results of the research in detail, please visit 👉 https://outlook.exponetwork.it/en/results

Written by Andrea Piccin

Andrea Piccin is Partner & Managing Director of GRS Research & Strategy Middle East, the leading research company for Exhibitions, Visitor Attractions, and Large Events. The company is specialised in Customer Experience Optimization, Customer Satisfaction, Mystery Shopping, Market Outlooks, and Data Science. He is married and proud father of two wonderful babies

Global